XRP Price Prediction: Bullish Potential Amid Regulatory Uncertainty

#XRP

- Technical indicators show mixed signals with MACD bullish but price below key moving average

- Regulatory clarity from Ripple-SEC case could be major price catalyst before August 15

- Institutional adoption grows through ETF products and payment system competition

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

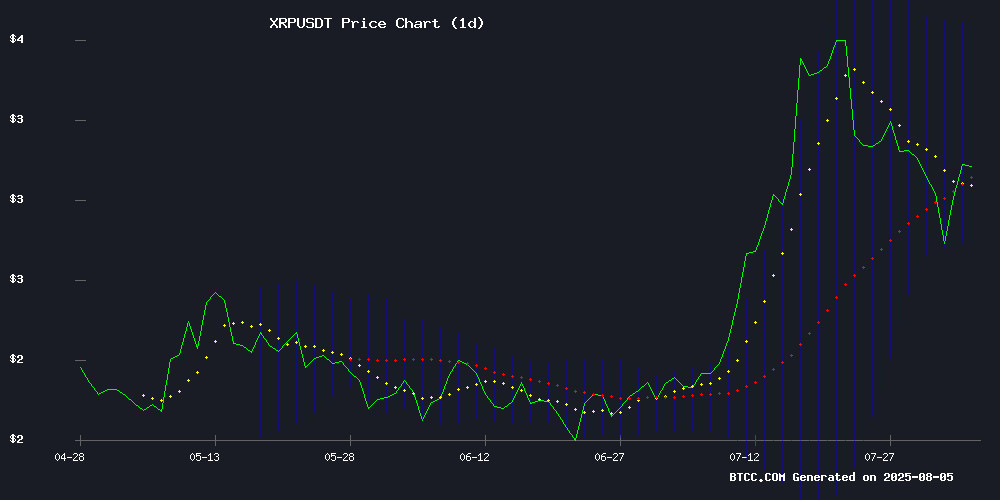

According to BTCC financial analyst Robert, XRP is currently trading at 3.03030000 USDT, slightly below its 20-day moving average (MA) of 3.1950. The MACD indicator shows a bullish crossover with values at 0.2104 (MACD line), -0.0555 (signal line), and 0.2660 (histogram). Bollinger Bands suggest a potential range-bound movement, with the upper band at 3.6188, middle band at 3.1950, and lower band at 2.7713. Robert notes that a break above the 20-day MA could signal a bullish trend continuation.

XRP Market Sentiment: Legal Developments and Price Action

BTCC financial analyst Robert highlights mixed sentiment in XRP markets. While the Ripple-SEC lawsuit nears its August 15 deadline, potentially bringing regulatory clarity, technical indicators suggest caution. Recent news includes record-breaking XRP ETF inflows and Ripple's CTO advocating for XRP's role in tokenized finance. However, the MVRV Death Cross and potential correction warnings temper optimism. Robert observes that breaking the $3.21 resistance could validate bullish momentum, but investors should monitor the lawsuit outcome closely.

Factors Influencing XRP’s Price

Ripple vs SEC Lawsuit Update: Delays in Dismissing Appeal Raise Questions

The prolonged dismissal process in the SEC's appeal against Ripple continues to draw scrutiny from legal experts and crypto market participants. While the regulator has swiftly resolved cases against other firms like Coinbase, its hesitation in the XRP litigation suggests deeper complexities.

Attorney Bill Morgan's public inquiry highlights bureaucratic hurdles—whether SEC Chair Paul Atkins can secure commissioner votes for dismissal and whether staff will execute the paperwork. Former SEC lawyer Marc Fagel revealed settlement talks collapsed after courts rejected proposed terms linking penalty reductions to injunction removals, forcing both parties back to square one.

The delay underscores regulatory ambiguity in crypto enforcement. Market observers note XRP's price remains sensitive to legal developments, with traders awaiting clarity on whether the SEC will persist in its claim that Ripple's sales constituted unregistered securities offerings.

XRP Faces Potential Correction Despite Short-Term Bullish Action

XRP has recently demonstrated bullish momentum, reclaiming key support levels in the short term. However, technical indicators suggest this upward movement may be fleeting. A bearish divergence on the weekly chart—marked by higher price highs alongside lower RSI highs—signals potential trouble ahead.

Historical patterns reinforce these concerns. The last similar divergence in late 2020 preceded a 60% price drop over three months. While interim recoveries occurred during that period, including a 70% bounce, the overarching trend remained decidedly bearish.

Currently trading around $3.05, XRP's recovery appears fragile against this technical backdrop. Market watchers note the cryptocurrency's tendency for short-lived rallies during broader corrective phases, suggesting traders should brace for potential extended downside.

Can XRP Break $3.21 and Kickstart a New Bullish Trend?

XRP's price demonstrates resilience following a recent correction, finding support at $2.75 and hinting at potential for a bullish trend recovery. A decisive breakout above $3.21 could mark the end of the corrective phase, opening the door to higher price targets.

Trading volume surged 27.69%, reflecting renewed market interest and reinforcing the bullish case. Initial recovery momentum stalled at $3.31 resistance, raising questions about whether the move was part of a larger corrective pattern. The $2.75 level—representing a 50% Fibonacci retracement—now serves as critical support.

Ripple's XRP Aims to Displace SWIFT in Global Payments

Ripple, the blockchain payments firm behind XRP, has declared its ambition to replace SWIFT, the decades-old interbank messaging system. CEO Brad Garlinghouse positioned XRP not as a partner but as a successor to the legacy network, citing inefficiencies in SWIFT's cross-border settlement processes.

SWIFT's infrastructure, used by over 11,000 institutions, often requires days for international transfers with multiple intermediaries. Ripple's blockchain solution promises near-instant settlements using XRP as a bridge currency, offering cost reductions exceeding 60% according to pilot programs with major financial institutions.

The cryptocurrency's resurgence comes amid improving regulatory clarity. While the SEC's 2020 lawsuit initially hampered adoption, recent court victories have strengthened XRP's position as a compliant cross-border payment instrument. Banking partners in Asia and Europe are now piloting production-scale implementations.

Ripple vs SEC May Conclude by August 15 – Implications for XRP Holders

The protracted legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) could reach its climax on August 15, marking a pivotal moment for XRP investors. After five years of litigation, the case now hinges on the SEC's internal procedures.

Speculation centers on the appeals process, with observers noting the absence of final filings. Former SEC official Marc Fagel clarified that both parties retain their appeal rights, but the next move belongs to the SEC. The agency must conduct an internal vote before formally withdrawing its appeal—a procedural step that precedes any court notification.

Once the SEC acts, Ripple is expected to file a corresponding notice. These documents will appear in the public docket, providing definitive proof of resolution. Market participants await this development, which could remove a longstanding overhang on XRP's valuation.

XRP Slides Post-Rally: MVRV Death Cross Signals Potential Correction

XRP, the native token of the Ripple ecosystem, has retreated 17% from its July 18 peak of $3.65, trading at $2.99 as of August 4, 2025. The decline follows a record high in mid-July, with weakening momentum now raising concerns among analysts.

A bearish signal emerged with the formation of an MVRV death cross, a pattern indicating potential sentiment shift from bullish to bearish. The metric compares market capitalization to the average on-chain acquisition price, with a short-term trend crossing below the long-term trend often preceding extended downturns. Crypto analyst Ali Martinez highlighted this development, noting historical correlations between such patterns and prolonged downside periods.

Trading activity reflects growing uncertainty, with XRP's 24-hour spot volume dropping 23% to $4.83 billion. The derivatives market shows similar caution, though specific data remains incomplete in the source material.

Teucrium’s XRP ETF Breaks Records as Investors Rush In

Teucrium Trading’s XRP-focused exchange-traded fund has become the firm’s most successful product in its 16-year history, attracting hundreds of millions of dollars within weeks of launch. The Teucrium 2x Long Daily XRP ETF, trading under the ticker XXRP on NYSE Arca, offers leveraged exposure to XRP price movements through derivatives.

Sal Gilbertie, Teucrium’s president and a self-described XRP enthusiast, confirmed the fund’s unprecedented demand during a CNBC interview. The firm’s pivot from agricultural commodities to digital assets reflects broader institutional interest in cryptocurrency investment vehicles.

Ripple-SEC Lawsuit Nears Final Verdict as August 15 Deadline Approaches

The prolonged legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) is nearing its climax, with an August 15 deadline looming for final submissions. The case, which began in December 2020, centers on allegations that Ripple conducted unregistered securities offerings through XRP sales. Market participants are bracing for potential volatility in XRP as the verdict could set a precedent for crypto regulation.

Former SEC official Marc Fagel notes the agency must internally vote to dismiss its appeal before formal filings are made. Legal experts emphasize the procedural steps remaining, but the clock is ticking for the SEC to act. The outcome may reshape not only XRP's trajectory but also the broader crypto regulatory landscape.

XRP Joins Bullish Trend After Breaking $3 with 6.5% Surge

XRP surged past the $3 mark with a 6.53% gain, signaling a potential turning point for the Ripple-backed token. Trading at $3.066, the asset is outperforming broader crypto markets amid growing optimism around regulatory progress and ecosystem expansion.

Market analysts highlight the significance of recent price action, with commentator EGRAG CRYPTO suggesting this could be the start of XRP's largest bullish candle yet. Volatility earlier in the week saw dips to $2.72 before the current rebound.

The ongoing SEC vs. Ripple lawsuit remains a key driver of sentiment, with an August 15 deadline looming. Traders are watching whether XRP can sustain momentum and trigger a larger breakout in coming weeks.

Crypto Unicorns Dwindle to Three in 2025 as Market Matures

The crypto landscape has undergone a dramatic consolidation, with only three Web3 companies—Ripple, OpenSea, and Alchemy—making CB Insights' 2025 Global Top 50 list. This stark reduction from previous years underscores a broader market shift: investors now prioritize sustainable use cases over speculative hype.

Ripple's $15 billion valuation anchors its position as a leader in cross-border payments, while OpenSea and Alchemy represent rare survivors in NFT infrastructure and blockchain development tools. Their endurance highlights the market's ruthless selectivity—only projects solving tangible problems withstand the tightened funding environment.

The absence of formerly hyped sectors like DeFi and meme coins from the unicorn roster signals a new era of institutional scrutiny. Web3's value is concentrating around established players rather than dispersing across experimental protocols.

Ripple CTO Advocates for XRP as Key Settlement Layer in Tokenized Finance

Ripple's Chief Technology Officer David Schwartz has positioned XRP as a pivotal asset for cross-border settlements in the emerging tokenized economy. Emphasizing its liquidity, jurisdictional neutrality, and scalability, Schwartz argues these traits make XRP uniquely suited to bridge global asset flows.

In a social media exchange with investor Andrei Jikh, Schwartz countered concerns about XRP's volatility by highlighting scenarios where real-time liquidity outweighs price stability. "There are use cases where volatility isn’t a minus, or is even a plus," he noted, suggesting digital assets' upside potential often compensates for short-term risks.

The discussion underscores a growing institutional recognition of crypto-native solutions for global finance. Unlike stablecoins designed for price parity, XRP's value proposition lies in its technical infrastructure—capable of settling transactions in seconds while serving as a transitional vehicle between fiat and tokenized assets.

Is XRP a good investment?

Based on current technicals and market developments, XRP presents both opportunities and risks:

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Technical Indicators | MACD bullish crossover | Price below 20-day MA |

| Regulatory | Potential SEC case resolution | Continued legal uncertainty |

| Adoption | SWIFT competition, ETF inflows | MVRV Death Cross warning |

Robert suggests that while XRP shows promising technicals and growing institutional interest, the pending SEC decision creates short-term volatility. A confirmed break above $3.21 with strong volume could signal a buying opportunity, but investors should maintain appropriate risk management.